The debt ratio (second part) Firstly I apologize for being late again for a long time, but I was absorbed by a number of commitments. Secondly, as always in these cases launch a warning: this post is unreasonably long (even for my standards), slightly repetitive, but I hope sufficiently clear. If you are not the heroes I suggest you read a little at a time. The GDP of a state can be defined in various ways equivalent to each other. On its page

of Wikipedia describes it as:

- the total production of goods and services economy, less intermediate consumption and increased net taxes products (added as a component of the final price paid by buyers);

- the sum of compensation of employees and corporate profits, will bear in productive, in fact, costs for the purchase of goods and services consumed by or process (intermediate consumption) and costs for the remuneration of production factors labor and capital , the net production of intermediate consumption, then coincides with the sum of the salaries of factors.

More schematically, the value of GDP is derived by adding together four factors: private consumption, gross capital formation, public expenditure and the difference between exports and imports.

In his article, Brock defines the elements that influence the change in GDP in a simple and intuitive.

They are: the change in employment and productivity changes. In other words, GDP is closely dependent on how many people total working within a state and how each individual is able to produce. This bond, including GDP, employment and productivity has been known for tempo.Tanto for example, the Australian Government nell'IGR (

Inter-Generational Report ) - a report that tries to predict the trajectory of GDP and of 'economy in the long term - is, for its calculations of five key variables:

- The level of the population over 15 years (the population)

- The rate of participation (how many people are working or actively seeking work, compared to the total population)

The employment rate -

- The average number of hours worked

- Productivity

In the first part of this article put in evidence that it is essential to increase the GDP of Italy in order to effectively reduce the ratio of government debt and the GDP. Act only on the debt turns out to be the long castrating a strategy destined to fail.

From Brock

considerations are clear as two roads that are covered in this sense: one that can lead to increased productivity and another can lead to employment growth.

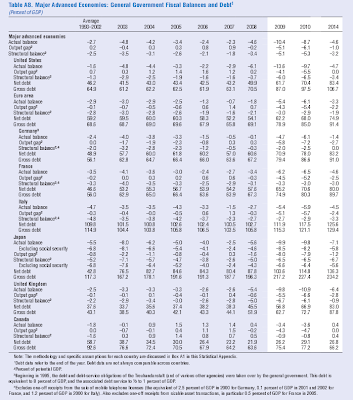

The table below, taken from the IMF World Economic Outlook, shows the trend in productivity, labor cost per unit and hourly earnings in the major advanced economies.

Just take a look and productivity in Italy compared to other big countries to understand that for some time in this nation, something is not going the right way. While Italy is dying with a variation productivity that floats just above and just below freezing, Germany - which not surprisingly is often used as an example - the cashes increases ranging from 3% to 7%.

As regards the level of hourly wage, the Italian figure shows, in recent years, rose more sharply than the German. It is, however, an increase that is altogether fitting to the average values \u200b\u200bcalculated by the IMF. Nothing short of dramatic. The real hole you pour from before when you compare the cost of labor per unit of output than Italian with German, though in 2005 it rose by 2.2% in Italy, in Germany fell by 3.1%. In 2006 in Italy, it grew by 4% in Germany, however, lowered the 4.2%. And so on.

In a nutshell, for several years now, wages in Italy have been rising faster than when productivity is increased and this was reflected in the cost of labor per unit of output, into climbing excessively. To overcome this problem, we could act on the side of reducing wages. In such a case would be more correct to speak of an increase in system efficiency and productivity, which effectively means the difference between costs in input and the output value of the goods. It is probably the easiest solution, but as I wrote above, the change in wages does not differ significantly from the average values \u200b\u200bof the IMF. We must act on them, but in a limited way (the speech will take up later).

The slope on which work is truly another: productivity.

The classic method for achieving increased productivity through technological innovation. An improvement of the technology available to companies allowing them to improve the automation, thus reducing the amount of human labor while increasing production. Moreover, given the high cost of advanced technologies, innovation contributes significantly to the GDP of a country through exports. Several studies then show how a work environment comfortable - ergonomic chairs, air-conditioned building, etc. - can increase worker productivity significantly.

If technological innovation is revealed as a fundamental element, the fact of hearing again on television, "the search! Where the search is over?" Is not a good sign. Italy is a country that invests very little in technological research. Both the state and - even worse - the private companies. We are a country that since the abandonment of the pound and the euro has lost control over its currency and the possibility of resorting to competitive devaluations. In other words, as a nation we should focus some time on the production of goods high technology with high added value and difficult to replicate from emerging.

Instead we concentrated on the production of low or intermediate level to compete with giants such as China. We have a myriad of small and medium-sized enterprises that lack the scale and resources necessary to invest in technological research and an entrepreneurial class that too often proved to be short-sighted and uneducated.

These are issues that have been heard often in TV debate albeit superficial.

Brock in his article puts forward some suggestions related to the case in the USA, how to intervene to increase productivity:

- Investments state infrastructure especially energy side

- stimulate technological innovation and venture capitalists

- Supporting Education and Elitism

- Imposing a tax system that rewards innovation and success

- Encouraging Investment in the private sector

- Reducing bureaucracy

I've written several times what I think of spending on infrastructure, especially in the midst of a crisis like the present one. Brock justifies all pulling in the ball Keynesian multiplier. It is a concept introduced in 1931 by Richard F. Khan, whereby an increase in public spending produces the effect of increased consumption that is a multiple of the initial expense. Unfortunately, as written by André Lara Resende, a Brazilian economist in a recent article

, has long been known that in a situation like today, where the rate of indebtedness of the population is extremely high, the Keynesian multiplier is not working.

people instead of spending the money that comes in your hands puts it off in the form of savings or use it to pay its debts, eliminating the multiplier effect. Beyond the considerations of Resende is the same concept of Keynesian multiplier to be challenged for some time.

In this article published in Forbes presents some of the positions classic diatribe on, referring to the economic stimulus for assistance made by the U.S. government.

In the Italian case is not even necessary to bother Keynes. Brock relies on public works in an investment today will bring a future benefit to the economy in the form of better service that saves time and energy going to improve then system-wide efficiency. In Italy many of the public works have historically proven to cathedrals in the desert. An unnecessary expense that has created few jobs, no lasting value and that was to weigh heavily on the state budget (

here you can read a recent article on the issue). It does not mean

che in Italia non vada mai fatta nessuna opera pubblica. Semplicemente in una situazione come quella odierna, potrebbe rivelarsi controproducente spendere in infrastrutture aumentando il Deficit statale, con il rischio di non ricavarne nessun reale vantaggio futuro e minimi vantaggi attuali.

Gli altri punti indicati da Brock li trovo tutti condivisibili e possono essere riassunti con: "incentiviamo l'innovazione".

Premiare il merito, sostenere l'educazione, favorire gli investimenti privati, ridurre la burocrazia e rimodulare l'imposizione fiscale sono tutti interventi che dovrebbero contribuire a fare emergere i migliori, i più colti, indirizzandoli verso la ricerca tecnologica e liberando loro la strada da barriere burocratiche and unnecessary tax imposts.

The Elite is a fact of life in any organized society. It is said to be worth the 80/20 rule - what is also called the Pareto principle by the Italian economist (Vilfredo Pareto) who first formalized in 1848. According to Pareto, in every society, 20% of the population comes naturally to be an elite. This matter what type of organization that the company has been given (fascism, communism, etc.). The point is, if anything, as this elite group is selected. If it is found through personal merit and the manifestation of undoubted ability, it is a valuable asset to the community, provided that an elite or if we call it in another way, the "ruling class" can not entail being above the laws and rules that apply to the remaining 80% of the population.

From this point of view, Italy is a disaster. The fact that there is a phenomenon called "brain drain" is telling. We train capable people in many different scientific disciplines, investing time and money to then make them run away, often unwillingly, to countries where their skills can be fully exploited.

In addition, a tax that does not encourage new businesses and small, often founded by young people, to invest in research. If we are full of small and medium-sized companies we could at least try to stimulate their growth and technological development. I often find myself say: "Google would never have been born in Italy." Too many obstacles, bureaucracy and taxes.

Brock suggests that strategies to encourage increased employment rates are 5:

- Strong GDP growth

- Composition of Deficit

- Deregulation of the labor market

- management of demographic change in the market Fiscal policy work

-

The first two points are a simple repetition of what has been set. Brock states that apply his advice on improving productivity incrementerebbe il PIL e quindi condurrebbe ad una conseguente crescita dell'occupazione dato lo stretto legame tra quest'ultima ed il Prodotto interno lordo di una nazione. Allo stesso tempo rimarca l'importanza di un incremento del deficit tramite la spesa pubblica in infrastrutture per aumentare l'occupazione, argomentazione su cui mi sono già espresso.

Nell'ultimo punto Brock si concentra sulla politica fiscale USA consigliando una riduzione della tassazione sul lavoro e l'introduzione dell'IVA (che non esiste od è minima in gran parte del territorio USA), una forma di tassazione che produrrebbe minori distorsioni sull'efficienza di un economia. Per quel che riguarda l'Italia possiamo vantare un'IVA molto elevata - del 20% per la Most of the goods - and the highest tax burden

on the work of the entire European Union. Another catchphrase of politicians and economists has been the reduction in labor taxes.

The main points suggested by Brock are the third and fourth. In particular the third, that the deregulation of the labor market has been a disaster in Italy since the mid-1990 onwards.

In a recent paper that you can find

on the IMF website, Martin Schindler, taking a merciless analysis of the Italian labor market. Schindler points out what should be the fixed points of any reform worthy of the name. First of all, should be avoided come la peste le riforme abbozzate. Ogni vantaggio che esse possono portare sul breve termine si trasforma alla lunga in un instabilità che pesa sull'intero sistema. In secondo luogo, ad essere fondamentale è l'ordine con cui le riforme vengono attuate più che le riforme in se stesse.

Due punti centrali che ho sempre sollevato quando mi sono trovato ad affrontare l'argomento "mercato del lavoro". A chi mi chiedeva se fossi d'accordo sull'abolizione dell'articolo 18 ho sempre risposto in maniera affermativa, aggiungendo però che se si trattasse di eliminarlo domani mi sarei detto contrario.

Prima vanno compiute altre riforme.

La riforma Treu del 1997 e quella Maroni del 2003, che hanno introdotto e then modified what is called "flexibility", had a positive impact on employment and made it grow progressively from 1995 onwards. The chart below, based on OECD data, clearly shows this trend:

The red line that represents the unemployment falls, while the participation rate of brown and black of the relationship between employment and The total population rose markedly. Most of the increase on the employment side, there was in the works completed and part-time. The work completed has increased from 1995 to 2007 from 7.2% to 12.4% while part-time rose from 10.5% to over 15%. Schindler says in absolute terms the number of workers to complete more than doubled during the period, while those with a permanent employment increased by only 7%.

This fall in unemployment could be regarded as positive if there were half a whole series of problems. The first is that once productivity. In the picture below you can see in graphical form what has made productivity in Italy compared to most industrialized countries over the period 1995-2006:

The productivity remained at the stake being overtaken by increased significantly hourly wage.

L'Italia insomma, come scrissi in precedenza ha puntato sull'efficienza più che sulla produttività. La flessibilità incrementa l'efficienza del sistema dando alle aziende la capacità di regolare le proprie necessità di manodopera in maniera dinamica a seconda dell'andamento del mercato. Uno strumento senz'altro comodo per le aziende, ma una crescita della produttività avrebbe bisogno di personale stabile, dall'elevata preparazione, individui quasi indispensabili (termine che farebbe inorridire molti economisti) che possano lavorare in un ambiente accogliente e con strumenti adeguati.

Invece ci siamo ritrovati con eserciti di persone costrette ad tirare avanti con contratti precari, stipendi bassi ed una great uncertainty about their future. 50% of unemployed Italians takes more than a year before finding a new job. As you can see in the picture below are the leaders in Europe on this side:

in Italy is worse is that unlike most other countries, temporary workers laid off if they find themselves without net. The reference model of the so-called "flex-security" are the Danish and the Dutch. It is said that the system should be efficient so flexible, but at the same time it should be fair, that should provide a number of social safety nets capable of supporting a flexible worker during those periods when there is no work.

The Italian labor market is plagued by deep asymmetries.

The first side on which action should be to market products, reducing the burden of regulations of which he is charged. There is talk of the set of bureaucratic burdens on businesses, professionals, operating as a barrier to entry against persons who are present for the first time on the market and so on. The OECD has developed an indicator in this sense that called PMR (product market regulation). To better understand what we mean when we talk about product markets listed below the diagram that summarizes the various voices used by the OECD to calculate the PMR:

E 'know that a market for products is strictly regulated negatively correlated with employment growth. In other words, if you want to improve the employment is necessary to have a system where it is easy to do business, we should not collide with an oppressive and costly bureaucracy, there is a genuine regime of competition, etc.. The image below, taken from the documentation Schindler, shows the correlation between PMR and employment - the higher the PMR and the lower employment:

The data base that has been the graph constructed above are those of the OECD in 2003. In April this year, the OECD has released updated data

on PMR (Schindler could not know that having his work published in March) where you can see some improvement in the index PMR Italy.

Despite the undoubted progress, I think it is undeniable that still hesitate a series of regulatory and competition barriers to entry and that should be demolished. And 'take advantage of the products on the market because the cost of direct tax of this kind of operation is almost zero - they are essentially bureaucratic and administrative adjustments - while the benefits would be numerous. According the model of Blanchard and Giavazzi of 2003 referred to by Schindler (especially if you're interested you can read something more

here): it would increase competition with a consequent increase in the level of employment and real wages on medium to long term compared to a temporary decrease of both.

may seem questionable to recommend a reform in the short term should be to worsen the situation on the side of employment and pay in the middle of a crisis like the present. It is, however, one of those structural changes whose benefits would be felt on a permanent basis and invest the entire economic spectrum.

It is said that young people should be liberated energy that the country has available. The problem is that these energies can not find a way to vent: large companies are often finding themselves in systems of limited competition, often considered more convenient to spend money to ingratiate himself with this or that political view of possible orders and contracts for government rather than invest it " leave the young energy "confront technology and development. For young people on the other hand is expensive and bureaucratically complicated to set up a new company and even if we are frequently able to face competition with unequal weapons that in many cases can count on "lean" that have nothing to do with a free market.

Mi rendo che può sembrare un eccessiva semplificazione della situazione, ma si tratta di problemi realmente esistenti che incidono pesantemente sulla produttività della nazione e sul suo sviluppo futuro. Recentemente il New York Times ha definito l'Italia come un "sistema feudale estremamente avanzato".

La parte più competente delle giovani generazioni trova da un lato un percorso che troppo spesso conduce ad una precarietà di durata indefinita e dall'altro ad una serie di porte sbarrate e grandi difficoltà nell'iniziare un attività da zero, specie se legata al campo della ricerca e della tecnologia. Non sorprende certo che nascano fenomeni come la "fuga di cervelli". In altri paesi si fa di tutto per incentivare immigration of individuals prepared especially in technology. In Italy the opposite is true: it seems that they try in every way to encourage emigration. A neutral attitude.

A country that invests in youth and the future is a country that does not have a future.

I therefore imperative to intervene on the side of regulation of product markets, encouraging competition and merit. Bizarrely on this side has done more with his left Prodi governments (you can then discuss the way) that not a word that Berlusconi had made the reduction of red tape and liberalizing certain his forte.

A market with more competition, greater vitality that is more agile and flexible also need a flexible workforce equally. Making flexible workers in a hard market has created some marginal benefits, while creating a social instability that has not impacted positively on productivity. This is an example of how important the order in which reforms are carried out.

The second thing to do after having acted on the PMR should be extended to all workers in a system of social protection. This is a necessary intervention on one of the most serious asymmetries of the Italian labor market. Some workers have safeguards and protections while another large group is left to itself, or rather to their families. It almost seems that the Italian government has said at one point: "Over the years, families have accumulated a fair share of wealth living beyond their means what in part reflected from debt of the state, whether through a support their children precarious. "

Whatever the motivation, I would like to point out that this is a political rather than economic. Most of the countries with which we normally confontiamo - defined as an advanced economy to be clear - are forms of economic assistance and subsidies that affect all workers equally. This ensures a person can survive for a certain period without employment and dampens the instability that a flexible system inevitably generates.

The current government has a position that would call schizophrenic about it.

Brunetta said in March:

'It's true. Minister Sacconi colleagues and I have provided some data. That confirms my own conviction: the Italian labor market, despite its contradictions, is admirable, practical, efficient, flexible, responsive, intelligent, and so its fair. Very "Italian", but with more lights than shadows. With so many people too many chances and privileges, I agree. But, as has been building in the postwar period, with a set of checks and balances, under the influence of business and labor forces, institutions, territori, culture, è il più efficace d'Europa. Relazioni industriali e ammortizzatori sociali compresi. Marco Biagi diceva che era il peggior mercato del lavoro».

Francamente mi trovo d'accordo con il povero Marco Biagi un signore che non smise mai in fase di scrittura della legge 30, attribuita postuma allo stesso Biagi, di insistere sull'istituzione di un sistema di ammortizzatori sociali per i lavoratori flessibili.

A Maggio Brunetta sembrava aver

cambiato in parte idea. Sulla crisi affermava:

«Paradossalmente ha reso più ricchi trenta milioni di italiani: tutti i lavoratori dipendenti e pensionati con i redditi saliti automaticamente del quattro per cento, mentre l’inflazione è al due. Il loro potere d’acquisto, dunque, è aumentato». E assicura: «Cambieremo questo Welfare scassato, che costa tanto e protegge solo i pensionati, poco i giovani e pochissimo le famiglie»

Sui costi che comporterebbe l'eventuale passaggio dal sistema attuale ad uno con una forma di protezione universale scrisse un

articolo Tito Boeri qualche mese fa, che vi invito a leggere nella sua interezza. Dice Boeri:

A regime con la disoccupazione costante, sarebbe pertanto necessario reperire circa 15,5 miliardi di euro, 8 in più di quelli oggi assorbiti dai vari tipi di sussidi di disoccupazione ordinari e a requisiti ridotti e dalle indennità di mobilità, that would be absorbed and made more generous with the one-time grant. If the one-time grant would replace the IGC also extraordinary, the net additional cost would amount to 6.5 billion.

The grant could be funded from a contribution of 3.3 per cent of pay, compared to today's contributions from 1, 6 and 2.4 percent for regular benefits and 1, 2 percent intended to Cig extraordinary and mobility benefits. Our calculations suggest that all places of work, except 3 million self-employed (true) grant will finance the ordinary. With an average salary of 20 thousand euro gross.

Boeri's hypothesis thus provides an increased contribution workers. A bold suggestion to do in the EU country in Europe that can boast the highest burden of taxation on labor. Taxes should be reduced instead. On this side of state intervention would be necessary. Despite everything, I think a universal system of social welfare and well-thought to be so fundamental, and its small enough to increase spending to support the suggestion of Boers. The only comment that I would make him about the stress test to which he subjected his model. It provides a level of unemployment of 10%, but if we get good estimates for the IMF in Italy next year unemployment will touch 10.5%.

Once the market is become more streamlined and flexible and that workers have obtained a universal security can be safely deleted Article 18. It would only be the anachronistic legacy of a bygone era, the privilege of a restricted class of workers.

The last important point on which focuses Schindler regards wage bargaining. In Italy the system is too rigid is a burden and a cost in terms of efficiency of firms. For Schindler, the bargaining power of firms should be increased. Normally the trade unions and workers do not take kindly, for obvious reasons, such transactions. In fund companies, it would gain the ability di moderare gli incrementi degli stipendi a seconda delle proprie necessità. Come compensazione, in un caso simile lo stato dovrebbe ridurre la tassazione sul lavoro dipendente in modo da incentivare i lavoratori ad accettare questo cambiamento. Chiedere un sacrificio in cambio di nulla secondo Schindler crea inutili tensioni e spinge i sindacati ad un netto rifiuto. Questo genere di accordi andrebbe concordato tra le parti.

Come esempi riusciti di simili operazioni Schindler cita il caso Belga, quello Irlandese e l'accordo Olandese di Wassenaar del 1982.

Il grafico sotto mostra la relazione tra la riduzione della disoccupazione ed un intervento sia dal lato della contrattazione che sul versante della tassazione sul lavoro:

According to the model of Schindler the best case in terms of employment would occur with a large tax reduction associated with a moderation of wages under the contract, while the worst case would be given an average tax reduction without moderation pay.

The graph below instead relates the cost to the state coffers of tax reduction measures - for the 4 cases examined by Schindler - with the increase of revenue in taxes that would be due to increased 'employment. In a nutshell it would cost the state each of the four cases under consideration:

Can note that the best case occurs with an average tax reduction and wage moderation, a competitor. Faced with an unemployment rate would drop by about 3% there would, after about a year and a half, a slight increase in tax receipts compared to the pre-reform level.

These three reforms: a reduction of PMR, extended to all workers of the fiscal shock, increasing the bargaining power of firms, combined with a reduction in labor taxes are the three fundamental reforms to be made about the labor market. Not necessarily the only ones. And 'it is understandable that when this subject the workers begin to worry about how they were seen in the past dealt with similar issues.

In this connection it may be useful to keep in mind the information on Schindler should act as a serious country:

- Try to make the system more competitive and productive

- carefully about the order in which to make reforms avoid like the plague reforms outlined

- Do not create instability, insecurity and social instability

- not ask for something for nothing

The last point raised by Brock regards the "management of demographic change in the market Work ", in other words how to deal with an aging population with the consequent increase in expenditure for pensions.

Brock is able to say that many of the baby boom generation, because of the economic crisis that has decimated pension funds, will be forced to retire at age 75. The U.S. will face an army of desperate old men who accalcherà front of the offices.

The issue is very serious and not just in the U.S.. As reported a few days ago all the newspapers, the OECD rap Italy. Our country has spent on pensions in 2005 14% of its GDP, about 30% of total public expenditure. Twice the OECD average. In the decade 1995-2005, the social security expenditure increased by 23%. Only countries such as Japan, Korea, Portugal e Turchia, secondo l'Ocse, hanno avuto aumenti simili (o superiori). Onestamente non mi pare che dal 2005 in avanti la situazione sia drammaticamente migliorata. Nella tabella sotto, presa dalla

relazione unificata sull'economia e la finanza pubblica , si può verificare, nella riga in fondo, la variazione % delle uscite degli enti previdenziali.

Esse sono aumentate del 6,9% tra il 2006 ed il 2007, del 3,6% tra il 2007 ed il 2008 e si prevede tra il 2008 ed il 2009, un aumento del 5,9%. La spesa previdenziale cresce troppo velocemente rispetto all'aumento del nostro PIL. Per ovviare a questo non esistono ricette magiche. O si aumenta la popolazione attiva, or reduce the amounts paid by pension funds or to increase significantly the usual GDP.

Increasing population means on the one hand send people retire later, another increase the rate of young working population through immigration. This pace of those who are intolerant towards immigrants. Beyond the rules for immigration and other economic aspects of the phenomenon that can be discussed and deserve a post in itself, the number of immigrants in Italy will only grow in the future. If people have not been "produced" in the past and will no longer be "produced" at a rate sufficient, it must be imported. That so raw, the choice is tra l'immigrazione ed il fallimento. Nessun partito politico qualunque cosa possa dichiarare in pubblico, sceglierà mai la seconda opzione.

Purtroppo non basta aumentare la popolazione attiva, bisogna incrementare anche il tasso di partecipazione, cioè la quantità di gente che possiede un lavoro o lo cerca attivamente - avendo la ragionevole aspettativa di trovarlo prima o poi - rispetto al totale della popolazione attiva. Vanno quindi aumentati anche i posti di lavoro. Ciò ci riporta ancora una volta all'incremento del PIL e alle riforme sopra esposte sul mercato del lavoro e sull'aumento della produttività.

Penso che a giochi fatti adotteremo tutte e 3 le possibili alternative per quel che riguarda il sistema previdenziale, going so far as to cut pensions.

summary:

Increase GDP by how the economic system is imperative to achieve an improvement in public accounts and the general economic situation, could prove more important than any cuts in public spending.

able to produce a GDP growth - or at least a less drastic decrease - in the midst of a terrible economic crisis like the present is neither trivial nor obvious:

- should be no expenditure on public works of dubious value that in the face of a temporary and limited improvement on the employment side worsen the budget deficit should be decreased

- PMR, facilitating the creation of new businesses, by easing the bureaucratic burden by eliminating a number of barriers to entry and toward investment. With a cost in the short term, permanent and lasting benefits would

- be promoted private investment in technology and venture capitalism as recommended Brock, through tax breaks

- should cut unnecessary spending. The cuts are made in Italy and there would be lots of unnecessary expenses to cut. Unfortunately in this country cuts are made too often indiscriminately, with the grass cutting too bad that that is good. Many unproductive expenditure, however, as those of a mammoth political machine that door clientele, expertise, blue car and a whole set of costs that added up generates a substantial figure, there are (strangely) never touched.

- reformed the labor market should be extended to all workers, social safety nets, reducing labor taxation and increasing the bargaining power on wages by businesses. The tax reduction on the workers should exceed the increase due to the creation of a universal subsidy to unemployment. Faced with declining tax revenue in the short term would have on the medium term an increase in employment and income.

- must act on social security spending, increasing the retirement age and cutting the social security spending. It is not nice to suggest, but now the question is no longer what we would like, but what we can realistically afford and at a similar, with some rates of increase, we can no longer afford it.

These are some suggestions if we are trivial - I simply tried to explain to a minimum, the economic logic behind it - on actions that I believe should be made. Are important qualitative considerations. I do not have the means nor the ability (and if I had I would not have sufficient time available) to say how much, quantitatively speaking, could cost this or that reform and that could generate future returns. Posso giusto appellarmi in linea generale ai calcoli di gente più competente di me (Schindler o Boeri ad esempio) o ai dati dell'OCSE e del Tesoro.

Naturalmente anche applicando tutte le indicazioni sopra elencate non è detto che le condizioni di questo paese migliorerebbero in maniera apprezzabile. La crisi che stiamo attraversando è qualcosa di inedito le cui ripercussioni sono difficili da prevedere.

Mi rendo anche conto che dire: "bisognerebbe fare questo e quello" è molto facile, metterlo in pratica complicatissimo. Escludendo però, una riunione generale dei principali soggetti economici del mondo, volta ad una riscrittura completa e concordata (niente a che vedere con la farsa dell'ultimo G20) del sistema world economy, I do not see many other interventions that Italy in its small way can make (any suggestion or objection in this regard is welcome).