These days are rained non-stop economic news of some significance, such as new moves designed by Citigroup to exit an agony that has dragged on for over a year, Bank of America could the same fate of Citi or the possible collapse of much of the American pension system. I would love to have four hands available and able to write something about it. Unfortunately I have to resign and limit myself to finish some items are still outstanding, including this drag behind me since last summer.

Europe

There a nice way to say it: the situation in Europe is a complete mess. The European Union comprises 27 countries of which only one side adopts the single currency. Some, such as Denmark and Britain maintain its currency for a specific choice, as other Eastern European countries are eagerly awaiting the moment you enter, for them, effect the euro. The economies of many union members are also focusing on specific sectors and each would require a monetary policy tailored. ECB policy essentially addresses the needs of an economy based on industrial production high level as that German and therefore inevitably ends up damaging i "pigs", come li chiamano gli inglesi, (anche se a quanto pare il termine venne coniato da un membro della deutsche bank) i paesi dell'area mediterranea caratterizzati da alti deficit pubblici e specializzati in produzioni di basso livello.

Prima però di lanciarmi in previsioni sul futuro dell'Europa vorrei che deste un occhiata alla tabella sotto compilata dalla Bespoke Investment Group :

Europe

There a nice way to say it: the situation in Europe is a complete mess. The European Union comprises 27 countries of which only one side adopts the single currency. Some, such as Denmark and Britain maintain its currency for a specific choice, as other Eastern European countries are eagerly awaiting the moment you enter, for them, effect the euro. The economies of many union members are also focusing on specific sectors and each would require a monetary policy tailored. ECB policy essentially addresses the needs of an economy based on industrial production high level as that German and therefore inevitably ends up damaging i "pigs", come li chiamano gli inglesi, (anche se a quanto pare il termine venne coniato da un membro della deutsche bank) i paesi dell'area mediterranea caratterizzati da alti deficit pubblici e specializzati in produzioni di basso livello.

Prima però di lanciarmi in previsioni sul futuro dell'Europa vorrei che deste un occhiata alla tabella sotto compilata dalla Bespoke Investment Group :

Essa riporta l'aumento del "rischio paese" registrato dai cds a 5 anni tra il mese di Novembre e quello di Dicembre. Come si può notare i paesi ad aver peggiorato in misura maggiore la propria situazione sono tutti Europei. Ai primi posti infatti, si trovano alcune tra le nazioni più pericolanti dell'area euro: Irlanda, Austria, Grecia. Più in generale però è stata l'intera Europa ad essere percepita a Dicembre, come un luogo molto più rischioso dal punto di visto finanziario, di quanto non fosse il mese precedente.

Va precisato che i cds sul debito sovrano sono uno strumento volubile, soggetto ad improvvise fluttuazioni e dall'utilità discutibile. Quando un intera nazione fallisce chi ha rilasciato assicurazioni contro un simile evento di solito tende a non avere abbastanza denaro per soddisfare tutte le richieste di rimborso. In sostanza fallisce anch'esso. Come ha illustrato Bank of America in un suo studio, i cds sul sovereign debt are useless or the words used by Tracy Allowy FtAlphaville in an article: "It is useless to you prepare for Armageddon.'ll be dead anyway."

remain, however, a good indicator of the risk in the short term.

The following table shows the cost of the Bespoke cds to 5 years for individual countries:

Va precisato che i cds sul debito sovrano sono uno strumento volubile, soggetto ad improvvise fluttuazioni e dall'utilità discutibile. Quando un intera nazione fallisce chi ha rilasciato assicurazioni contro un simile evento di solito tende a non avere abbastanza denaro per soddisfare tutte le richieste di rimborso. In sostanza fallisce anch'esso. Come ha illustrato Bank of America in un suo studio, i cds sul sovereign debt are useless or the words used by Tracy Allowy FtAlphaville in an article: "It is useless to you prepare for Armageddon.'ll be dead anyway."

remain, however, a good indicator of the risk in the short term.

The following table shows the cost of the Bespoke cds to 5 years for individual countries:

According to this table, the eurozone, whose sovereign debt is more expensive to insure and thus are considered more risky in the order they are: Greece, Ireland, Italy, Austria, Spain and Portugal. If a failure happens, one of the countries currently adopting the euro concern in all likelihood, one of these nations. Which brings us back to the question I posed (to nothing) more than once: "What happens if a European country goes bankrupt?"

If you were dealing with a nation of limited size and with a GDP of about $ 250 billion as Ireland, the rest of Europe might try to intervene in some way, by providing loans or cash in other forms, but already with Austria, whose GDP is around $ 380 billion, the situation would be unmanageable, not to mention of course of what would happen in case of failure to English or Italian.

If one of the greatest nation in the EU were to come to failure, significant risk of being excluded by the euro with terrible consequences both for the single currency for the Union, whose own integrity would be questioned.

countries such as Ireland, Austria, Greece, Spain and England, in one way or another, have got shit to the root of the hair in a massive credit bubble that has affected economies around the world from 2003 onwards and now, after years of rapid growth, they are forced to deal with an equally rapid decline.

The case of Ireland can be summed up with a joke that circulates among economists: "The only difference between Ireland and Iceland is in the letter r". In fact, Ireland seems to have accurately followed the recipe Icelandic overexposing its banking sector to a huge housing bubble, making him play with little pieces of paper from dubious value and attracting substantial foreign capital due to favorable tax conditions. When the bubble burst Irish banks have found themselves one step away from bankruptcy and as always happens in these cases the state had to intervene to save them. The foreign capital but, given the internal condition of the country are taking off.

Ireland is now € 400 billion guarantee of its exposure to banking, a figure two times higher than its GDP. Unemployment in the country has soared to touch 10% while consumption fell. The only thing that prevented the little Ireland to the end of Iceland was the protective umbrella provided by the Euro. If Ireland had had a local currency value of the latter would precipitate a long time, dragging it into the abyss along with the entire economy. What

by the euro, however, can not defend and the Standard & Poor's. The famous credit rating agency has placed the ratings of Ireland, together with that of Spain and Portugal, in preparation for a possible downgrade.

Even in Spain in fact, is taking an economic carnage. Such as Ireland and England, Spain was launched by early 2000, in an insane real estate bubble con tutti gli annessi e connessi del caso. Una massa gigantesca di finanziamenti invase il paese grazie ai bassi tassi di interesse adottati dalla BCE. Nel grafico sotto si può notare come da metà del 2003 fin quasi all'inizio del 2007 il tasso di interesse reale sia stato pesantemente negativo (il tasso di interesse era inferiore al tasso d'inflazione). L'incentivo ad indebitarsi era troppo forte e gli Spagnoli vi risposero entusiasti.

If you were dealing with a nation of limited size and with a GDP of about $ 250 billion as Ireland, the rest of Europe might try to intervene in some way, by providing loans or cash in other forms, but already with Austria, whose GDP is around $ 380 billion, the situation would be unmanageable, not to mention of course of what would happen in case of failure to English or Italian.

If one of the greatest nation in the EU were to come to failure, significant risk of being excluded by the euro with terrible consequences both for the single currency for the Union, whose own integrity would be questioned.

countries such as Ireland, Austria, Greece, Spain and England, in one way or another, have got shit to the root of the hair in a massive credit bubble that has affected economies around the world from 2003 onwards and now, after years of rapid growth, they are forced to deal with an equally rapid decline.

The case of Ireland can be summed up with a joke that circulates among economists: "The only difference between Ireland and Iceland is in the letter r". In fact, Ireland seems to have accurately followed the recipe Icelandic overexposing its banking sector to a huge housing bubble, making him play with little pieces of paper from dubious value and attracting substantial foreign capital due to favorable tax conditions. When the bubble burst Irish banks have found themselves one step away from bankruptcy and as always happens in these cases the state had to intervene to save them. The foreign capital but, given the internal condition of the country are taking off.

Ireland is now € 400 billion guarantee of its exposure to banking, a figure two times higher than its GDP. Unemployment in the country has soared to touch 10% while consumption fell. The only thing that prevented the little Ireland to the end of Iceland was the protective umbrella provided by the Euro. If Ireland had had a local currency value of the latter would precipitate a long time, dragging it into the abyss along with the entire economy. What

by the euro, however, can not defend and the Standard & Poor's. The famous credit rating agency has placed the ratings of Ireland, together with that of Spain and Portugal, in preparation for a possible downgrade.

Even in Spain in fact, is taking an economic carnage. Such as Ireland and England, Spain was launched by early 2000, in an insane real estate bubble con tutti gli annessi e connessi del caso. Una massa gigantesca di finanziamenti invase il paese grazie ai bassi tassi di interesse adottati dalla BCE. Nel grafico sotto si può notare come da metà del 2003 fin quasi all'inizio del 2007 il tasso di interesse reale sia stato pesantemente negativo (il tasso di interesse era inferiore al tasso d'inflazione). L'incentivo ad indebitarsi era troppo forte e gli Spagnoli vi risposero entusiasti.

Il denaro a basso costo che il settore bancario Spagnolo si trovò a disposizione venne riversato in parte sul mercato immobiliare e derivati connessi, ed in parte fu usato per finanziare i paesi emergenti in America Latina nei confronti dei quali le banche Spagnole sono exposed, according to the BIS (Bank for International Settlements) for more than 300 billion.

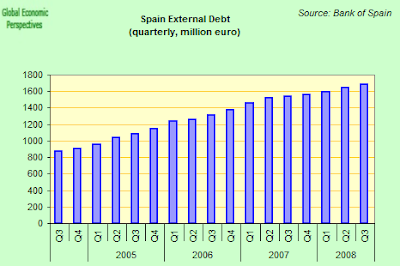

Il denaro a basso costo che il settore bancario Spagnolo si trovò a disposizione venne riversato in parte sul mercato immobiliare e derivati connessi, ed in parte fu usato per finanziare i paesi emergenti in America Latina nei confronti dei quali le banche Spagnole sono exposed, according to the BIS (Bank for International Settlements) for more than 300 billion. the country's external debt has almost doubled in four years increasing from 870 billion euro in the third quarter of 2004 to 1686 in the third quarter of 2008 (155% of GDP).

Now that the various bubbles have burst one after the other (or if you prefer the giant bubble that enveloped the entire planet) Spain is to face an internal situation which is gradually deteriorating. In December, the PMI (purchasing managers index) index of manufacturing activity came in at 32.1 share (under 50 points we are talking about contraction industrial production). The unemployment rate has fallen to 13.4% in November while industrial production fell by 15.1% year on year. The English economy, worried about rising unemployment scary, animated discussion, trying to predict the maximum level that it will touch before the crisis to complete its course. Some predict an unemployment rate of 20% and who is even talk of a 25%, a level from the Great Depression. Meanwhile, Latin America, against which the English banks are exposed, is declining very fast.

The situation in Austria is similar to that of Spain. Fortunately, the Austrians have not thrown in speculation comparable properties. On the other hand, however, the Austrian banks have seen fit to invest about 290 billion euro in the countries of Central and Eastern Europe - from Albania to Russia - countries that could boast during the boom years, very high growth rates thanks to the influx of foreign capital and easy access to credit, but who are now agonizing kept alive by infusions of a loan that the IMF and Europe has given them. The Austrian government has intervened in recent months, accompanied by the billion recapitalization, to support its banking sector. This is at least the facade. In reality everyone knows perfectly well that most of the money will go to support the Eastern European countries that without the support of the Austrian banks could not survive. The failure of even one of these countries would create a deeply destructive chain reaction that involves the whole of Austria from the EU.

the European states, however, which lately has been imposed with arrogance general attention is Greece. As revealed by a the Telegraph article, in recent years, industry shipments of goods by sea has replaced the tourism sector of the economy becoming the first Greek. The owners of the country controls a third of the market for bulk shipments by sea of \u200b\u200bthe planet and to fund its operations turned to the banking system, international banking, mainly British banks. Now the maritime trade has fallen to its lowest terms . The Baltic index has virtually wiped out, falling 96% from its peak last summer. Furthermore, Greek banks had given to shopping real estate in the Balkans (especially Serbia and Macedonia) and Turkey. Other countries with economic weaknesses have emerged following the economic crisis. It is not surprising that Greece is accused in a particular crisis. The country has a high debt ratio (94%) while the deficit is equal to 15% of GDP (the highest in the eurozone). Two days ago, Standard & Poor's cut its rating of the country bringing to A-, an event that will help ad aumentare la pressione nei confronti degli altri stati Europei sotto osservazione.

La situazione Italiana purtroppo, meriterebbe un post a se stante. L'Italia è un paese immobile: non è cresciuto particolarmente durante gli anni della follia creditizia, ma almeno adesso, non si trova a dover precipitare per ribilanciare passati eccessi. Nonostante ciò la borsa Italiana non si è difesa bene nell'ultimo anno, come si vede nella tabella sottostante.

The situation in Austria is similar to that of Spain. Fortunately, the Austrians have not thrown in speculation comparable properties. On the other hand, however, the Austrian banks have seen fit to invest about 290 billion euro in the countries of Central and Eastern Europe - from Albania to Russia - countries that could boast during the boom years, very high growth rates thanks to the influx of foreign capital and easy access to credit, but who are now agonizing kept alive by infusions of a loan that the IMF and Europe has given them. The Austrian government has intervened in recent months, accompanied by the billion recapitalization, to support its banking sector. This is at least the facade. In reality everyone knows perfectly well that most of the money will go to support the Eastern European countries that without the support of the Austrian banks could not survive. The failure of even one of these countries would create a deeply destructive chain reaction that involves the whole of Austria from the EU.

the European states, however, which lately has been imposed with arrogance general attention is Greece. As revealed by a the Telegraph article, in recent years, industry shipments of goods by sea has replaced the tourism sector of the economy becoming the first Greek. The owners of the country controls a third of the market for bulk shipments by sea of \u200b\u200bthe planet and to fund its operations turned to the banking system, international banking, mainly British banks. Now the maritime trade has fallen to its lowest terms . The Baltic index has virtually wiped out, falling 96% from its peak last summer. Furthermore, Greek banks had given to shopping real estate in the Balkans (especially Serbia and Macedonia) and Turkey. Other countries with economic weaknesses have emerged following the economic crisis. It is not surprising that Greece is accused in a particular crisis. The country has a high debt ratio (94%) while the deficit is equal to 15% of GDP (the highest in the eurozone). Two days ago, Standard & Poor's cut its rating of the country bringing to A-, an event that will help ad aumentare la pressione nei confronti degli altri stati Europei sotto osservazione.

La situazione Italiana purtroppo, meriterebbe un post a se stante. L'Italia è un paese immobile: non è cresciuto particolarmente durante gli anni della follia creditizia, ma almeno adesso, non si trova a dover precipitare per ribilanciare passati eccessi. Nonostante ciò la borsa Italiana non si è difesa bene nell'ultimo anno, come si vede nella tabella sottostante.

Tra i paesi dei G7 siamo quello che ha riscontrato le perdite più marcate. Non siamo i peggiori in Europa, ma sotto di noi troviamo ancora una volta i soliti sospetti: Austria, Grecia, Irlanda ecc.

The problems of the Italian economy are different from a very high public debt that does not want to fall. Indeed, as was expected for another in a situation of economic crisis, the debt has increased reaching 1.6706 trillion euro. The public sector borrowing requirement is rising rapidly increased from 26.5 billion in 2007 to 52.9 in 2008. The bot redimenti of Italian at the same time have touched historic lows. It is not a good sign. It reflects the great fear of investors and small investors and their distrust of the stock market. About the bonds in the face of great demand by small entities, it should be noted that the scorso mese andarono deserte 3 aste per specialisti . Gli specialisti sono acquirenti all'ingrosso dei titoli di stato (se volete farvi tanto male qua trovate la definizione precisa), essenzialmente banche e grossi istituti finanziari. Non è rassicurante il pensiero che i grandi soggetti non si fidino particolarmente del debito sovrano dell'Italia. La risposta del tesoro a questo avvenimento è stata :

side of public funding should go all right, the crisis will be felt in all its brutality in other sectors. Our economy depends in large part from extremely sensitive to a global recession, such as tourism, the production of luxury goods or the manufacturing of low-level, from which we can not release when we should have.

Industrial production has fallen by a terrifying 12.3% in November compared with a year earlier. The bank d'Italia prevede che il PIL del paese scenderà di un 2% quest'anno e avverte che "la dinamica del prodotto potrebbe essere ancora più negativa se prendessero corpo i rischi di un ulteriore indebolimento dell'economia mondiale". Considerando che i rischi "prenderanno corpo", ci baceremo i gomiti se raggiungeremo un -2% di PIL.

Se sui "pigs" sta piovendo acido puro, anche la spocchiosa Inghilterra non si può certo dire all'asciutto. Dopo aver tagliato i tassi al minimo storico (ora sono all'1,5%) da quando è stata fondata nel lontano 1694, provocando il tracollo della sterlina, la banca centrale inglese ha deciso fosse il caso di tenere segreti i propri libri contabili . Essa potrà print all the money he wants and no one can know how much it puts into circulation or in the words of condemnation spoken by Lord James of Blackheath to the English Room:

Translated: central bankers are convinced that they know how to keep inflation at bay e quindi non se ne preoccupano particolarmente. Questa è una delle ragioni principali (ce ne sono altre) per cui ricorreranno a tutte le forme di quantitative easing che riterranno necessarie. Chi dice che una banca centrale abbia il potere di creare inflazione in quantità illimitata ha ragione. Una banca centrale potrebbe effettivamente creare denaro e distribuirlo lanciandolo dagli elicotteri come ha minacciato di fare Bernanke o appenderlo ai rami degli alberi come suggerisce Pritchard o ancora infilarlo dentro a delle bottiglie, spargerle per la nazione ed indire poi una gigantesca caccia al tesoro come postulò (scherzando) Keynes.

Sarebbe più corretto dire che una banca centrale, non può creare inflazione in maniera illimitata sperando di conservare intatto un qualcosa che possa essere definito "economia", come dimostra la situazione dello Zimbawe che a 3 settimane dall'introduzione della banconata da 500 milioni ha dovuto introdurre quella da 50 miliardi. Adesso nel paese africano usano valuta straniera per vendere ed acquistare merci. In questo senso Bernanke e amici non hanno grosse speranze di rimettere in moto l'inflazione. Se cercassero seriamente di farlo, genererebbero uno shock tale da provocare un arresto cardiaco all'intero sistema.

Penso che in futuro l'Inghilterra, assieme alla Spagna, entrerà nei libri di storia come l'esempio di un paese, in cui l'espansione economica negli anni 2000 è stata quasi esclusivamente basata su bolle speculative. Vi ritroviamo all distortions of the U.S. economy, only on a higher scale. Britain, too, like the United States embarked headlong on speculation and U.S. citizens as the British were indebted to the tip of the hair to consume useless crap - in fact we are indebted to an even more marked from the Americans - while the banking system bundle the package and is also up to their necks in debt to invest in all those areas that the global financial bubble was inflating.

The British banking system has ended up exposing too. When you start to see banks with a leverage (the ratio between the money available and the total exposure) of 1:60, as in the case of Barclays, it should be evident that you have exceeded any reasonable limit. In comparison, U.S. banks have made worse the leverage of about 1:30. As soon as the various bubbles burst began the agony of the British banks. Zeroing in demand for complex financial instruments, the terrible conditions faced by hedge funds and private equity, have vaporized much of that financial market that for years had become the first industry in the country.

A banking system is exposed as the English could not survive independently in an event like that. To save the state has intervened effectively nationalizing many institutions (the Royal Bank of Scotland for example). The population also found itself forced to stop consuming with money that did not possess and increase the savings rate . The result was a contraction of the economy and money in circulation. To remedy this, the government has promised several public interventions in the form of investment and tax cuts, such as a reduction of VAT by two percentage points. The result will be a frightening increase in the deficit in the near future: it is estimated 6% of GDP in 2009, but many fear it could soon reach a level of 10% from Latin America (or Greece). Smagni Bisi Lawrence, head of international affairs at the ECB, says that the UK is not material for the euro because of budget deficit and instability in the exchange rate of sterling, which the recent weakening is considered by many as a form of "beggar thy neighour.

France and Germany still remain the major countries of Europe. Their economies are suffering amid many will be those that resist better at this time of crisis.

Germany from its accounts with respect to order, good facilities and good social safety nets, an industry trade balance and a high-level asset. Other hand, has the enormous exposure of its banking sector and a large dependence on the export sector in a time when global demand is almost zero.

Deutsche Bank, for example, although not reaching absurd levels of Barclays has come to have a leverage of 1:52. As with the British bank, the German government has intervened a couple of days ago, acquiring a majority share of the banking giant, in a complex deal for the sale of Postbank - owned by Deutsche Post - the Deutsche itself. Without government intervention the operation could never be completed.

The total exposure of Deutsche has 80% of German GDP. Nor is his failure to be taken into account. If Germany a few days ago has come to nationalize the Commerzbank acquiring a 25% plus one share and speculation on whether the same can be done against Hypo, the financial giant (comparable in size to the former Lehman) got shit completely in the housing market, it is natural that in case of future problems (and there will be) by the Government of the Deutsche will be obliged to intervene further.

The German industrial production data are from war report. In November, the decline was 7.7% compared to the same month last year. In 2008, the country's GDP grew by 1, 3% half since 2007 and exports increased by 3.9% versus 7.5%, again in 2007. The German statistics office estimated that the decline in GDP last quarter was tra l'1,5 e il 2%. Anche se i dati ufficiali saranno rilasciati solo il 13 Febbraio uno dei responsabili dell'ufficio ha detto: "la crescita economica nel 2008 è stata unicamente basata sulla domanda interna". Probabilmente un po' eccessiva come analisi, ma la dice lunga su quanto in fretta l'economia tedesca si stia raffreddando.

Joerg Kraemer capo economista alla Commerzbank ha affermato commentando le previsioni per l'ultimo quarto: " Questo significa che il punto di partenza per il 2009 è pessimo". "Ci aspettiamo che il PIL si contrarrà di un 2-3 percento nel 2009, il che rappresenterebbe il declino peggiore nella storia della Repubblica Federale". Esportazioni in calo e consumi interni stagnati nonostante un alto (per hour) level of employment, are corroding Germany. To answer the question the German Government has decided to act with a stimulus package of 50 billion euro.

usual stuff: tax cuts, expenditure on infrastructure (schools, roads, etc.), bonus for families. The government expects to save 250,000 jobs this way.

France for its part, has repeatedly called for the cooperation of Germany with a view of an economic stimulus plan coordinated at the European level and always receive a negative response. The Germans do not want to spend their money to keep the "pigs". They fear if they did, to lay the foundations for the future adoption of the common forms of debt, which is not absolutely in their interest.

France also going through a difficult time. The luxury market, one of the highlights of the French economy is in trouble : Channel has fired the 1% of its workforce (slightly, but enough to arouse dismay among commentators French), Louis Vuitton has annulled ' Opening in Tokyo I had to be its largest store ever, and champagne sales were down 16.5% in October. Industrial production in November fell by 2.4 over the previous month compared to an expected decline of 0.8%. The decrease year on year by 6.5%. The largest contribution to the collapse of industrial production has given him the car industry with a monthly drop of 8, 1% in November after having fallen by 22.2% in October. The situation is severe enough to push the President Sarkozy to announce measures of direct financial assistance from the government for the whole sector. In return, the automakers should commit to strengthening the production in France by limiting the practice of outsourcing. It is also rumored to the next state aid to Airbus. The aviation giant has said to expect a halving of orders in 2009 over the previous year.

From this quick overview of the situation of some major European countries should be clear why Many believe that the worst conditions in Europe to the United States.

is an entity without an economic policy or monetary policy. Although most of the countries that compose it (16 now) falls under the protection of the euro 11 others are left out. They are mostly small states in Eastern Europe still retain its own currency and on almost all the bad economic situation in serious condition. In the boom years of the investment are realized attracted by high growth rates that they could boast. When the crisis erupted in the capital have fled their heels leaving behind businesses, and individuals were heavily indebted to international currency: U.S. dollar, euro, Swiss francs Swiss and even yen. The result of this flight was the devaluations of local currencies, which consequently led to an increase in real terms of the stock.

The stability of these countries is important for nations in the euro area since they are among those who have invested the most in the region of Eastern Europe. So for right or wrong we will have to save them if necessary.

Another problem of Europe is not able to issue debt policy. Each state must finance themselves. This means that any difference in the stability of the economies is reflected by the difference in yields that every state has to promise to pay on its debt. In other words è molto più sicuro investire nel debito di in un economia "compatta" (pur con tutte le differenza tra i vari stati) come quella USA che non nella singola Italia o Inghilterra. In un momento a cui il mercato sembra comprensibilmente interessare solo la sicurezza, significa che gli stati visti come più pericolanti (Grecia, Irlanda ecc) potrebbero avere in futuro dei problemi a vendere il proprio debito.

Mentre stavo scrivendo questo post, Willem Buiter ha pubblicato un articolo che riflette bene alcune delle argomentazioni che avanzai in passato. Buiter afferma che sia assurdo, anche solo pensare che qualche paese dell'area euro possa decidere di abbandonare la moneta unica. L'effetto positivo che deriverebbe dalla svalutazione a competitive local currency runs out, leaving the country in question, at the mercy of a market ruled by giants in the economic policy it should adapt. A local currency would quickly be a burden. The example of Iceland stands still in the minds of politicians, as an enduring reminder of the consequences that may result from having a currency is too weak and insignificant at the international level.

No country voluntarily abandon the euro. Whatever you may say political parties such as the alloy. If for some reason Italy was driven by the euro, and Bossi would see the company go to Bruxless crawl and beg other countries to make us fall. They can scream that they want their supporters to Pontida, between sips of water while '(I hope the first depurino) and a slice of polenta, but they are not stupid. They know that abandoning the euro would be a disaster for Italy.

Buiter welcomes any European country having to issue his personal debt, a joy that frankly do not understand. The spread between yields on Treasury bonds of individual European countries is increasing continuously. The good of Greece promise to yield 2.12% more than in Germany, a catkin of 10 times in the last 2 years. John Authers in the Financial Times says that the market is considering the probability that one of the eurozone countries to abandon the single currency until the end of the year to 30%. Buiter does not care about the thing. He says that the increase in spreads on sovereign debt will force countries to adopt a worst form of stricter fiscal discipline and therefore will have a positive effect.

expect that we will, in default of sovereign debt by countries within and outside the euro area, forecast with which I agree, but does not bother to analyze the consequences. What they decide to make the other European countries facing the default of a state within the single currency?

An indication on the road that could take Europe in such a case, comes from the decision by the ECB to loosen the requirements on guarantees accettabili in cambio di prestiti. Il debito sovrano era eleggibile fino ad un rating di A-. Un altro abbassamento di rating avrebbe messo fuori gioco i buoni del tesoro Greci. La BCE ha quindi deciso in via transitoria (di questi tempi il transitorio ha il brutto vizio di diventare permanente) di accettare debito sovrano fino al rating BBB-, cioè fino al limite inferiore di quello che viene definito "investment grade" (livello da investimento).

Con tutta probabilità in caso di default su alcune tranche di debito pubblico, verrebbero semplicemente allentati i vincoli economici imposti dall'Unione e come ritiene Buiter il default verrebbe definito "ristrutturazione." In pratica l'Europa cercherà di nascondere la polvere sotto il tappeto as long as possible. Obviously there is a limit beyond which other countries do not agree to go because the cost of supporting countries to shoulder the failures would become excessive.

This economic crisis will stand the test of 9 for the compactness of the European Union. The year that has just started is the worst it has ever seen in his short life. Industrial production continues to decline. Factories, companies, small and medium-sized enterprises license by increasing the rate of unemployment. In 2008 in Italy was 6.7% for 2009 and economists are predicting that will touch the 8, 4%. In all probability exceed 9% and we get to double figures. Ireland and Spain are already in double figures. Greece is 7.4%, but unemployment among young people aged between 15 and 24 years is 22% (many say the real figure is closer to 30%). Greece has been replicated in the process of impoverishment and insecurity of the young generation that has affected much of the industrialized world and it seems clear that Greece did not know how to respond to the betrayal of that promise by implication, improvement of living conditions that exist between the previous generations and those that follow and the subsequent rebellion of young citizens.

The fuse has been triggered in Greece, but the fire of violent revolt threatens to take root in other countries. At year end, the people of Iceland said the assault , torches in hand, the seat of the second television channel where the prime minister, was discussing the prospects of the country for 2009, including an appetizer and a glass of champagne. The kind of idiotic behavior that I would expect from an Italian politician. Icelanders are generally reserved and a population not prone to violence. E 'to fail because the state saw similar actions. In some European countries, I doubt that you will need to wait that long. The

Eastern Europe is in danger of default again (they never really recovered) and will be re-saved the Union and the IMF, but we can expect very strong social tensions. Greece will not come if to declare default on certain installment of its debt, in danger of going there very close. Pay particular attention to the Mediterranean countries Spain, Portugal, Greece because their future is our future, but their fall will be faster than ours. In the first half of the year probably will not arise on the real problems of financing government bonds, but around September / October I expect a staple of suffering. Europe's response will, as always contradictory and not very timely and is expected to result in substantial suspension (or release if you like) the constraints of stability.

deflationary thrust will continue its course. Consumption will inevitably continue to shrink as the economy will get worse, dragging down the values \u200b\u200bof those assets that past bubbles were inflated. Mainly residential and commercial properties, but also small business or those whose business is based on real easy to cut as clothing or cosmetics will suffer a severe blow. Sales will decline less than discount stores, large supermarkets, large retailers in other words. Will suffer less the impact of the crisis, at least in Italy, electronic objects of desire, such as cell phones or mp3 players (in the first half then he Thin). Also in this area but we will see a heavy compaction. Here is the festival in Bologna the closure of UniEuro (there would actually be a lot to say about their business plans). For the computer will be a bad year and for the automotive market will be even worse.

isolated interventions of the various states will do little to change that.

positive, the Europe than in the U.S. (in most states) a debt the individual child, services that work (public transport to name just one) and a welfare state established, it will not be enough to make a difference. The revenue decline while the states will inevitably increase the deficit. Depending on how this crisis will last for the welfare of devices will be able to provide a cushion or you riveleranno insufficienti. In Italia si sente ripetere un giorno si ed uno no, che i fondi per la cassa integrazione non bastano (e questo senza considerare l'adozione di rigide misure fiscali come suggerisce Buiter).

Per combattere la deflazione la BCE si arrederà e ricorrerà a esplicite misure di quantitative easing, oltre a tagliare ulteriormente il tasso di interesse. Aspettatevi un futuro indebolimento dell'euro, derivante sia dalla politica che adotterà la banca centrale sia dal degradarsi delle economie dei paesi membri. Anche la sterlina continuerà a svalutarsi. La Gran Bretagna sembra non cercare neppure di dissimulare le proprie intenzioni in questo senso.

Le banche del vecchio continente, tranne some cases such as Italian, have higher levels of leverage than their U.S. counterparts. They are therefore highly exposed to the difficulties that the world economy is going through. Some have too much invested in emerging markets, others are unbalancing the first real estate bubble and then in the commodity and others have exposed too much about everything. There is no way that they come out unscathed. Continue to spit blood for all of 2009 and since her failure does not appear to be under discussion, will be saved at taxpayers' expense.

not come from price lists also particularly good news. In exchange, probably will see the replica of what happened this year. If the bag American will fall another 40%, not European ones will fare better, on average, their loss will be higher.

To conclude: if the U.S. did not laugh this year, Europe risks instead of bitter tears. Expect the situation to fester in the fall and keep a close eye on Spain, Greece, Ireland and Eastern Europe. Will be a great barometer to see what awaits us ahead.

The problems of the Italian economy are different from a very high public debt that does not want to fall. Indeed, as was expected for another in a situation of economic crisis, the debt has increased reaching 1.6706 trillion euro. The public sector borrowing requirement is rising rapidly increased from 26.5 billion in 2007 to 52.9 in 2008. The bot redimenti of Italian at the same time have touched historic lows. It is not a good sign. It reflects the great fear of investors and small investors and their distrust of the stock market. About the bonds in the face of great demand by small entities, it should be noted that the scorso mese andarono deserte 3 aste per specialisti . Gli specialisti sono acquirenti all'ingrosso dei titoli di stato (se volete farvi tanto male qua trovate la definizione precisa), essenzialmente banche e grossi istituti finanziari. Non è rassicurante il pensiero che i grandi soggetti non si fidino particolarmente del debito sovrano dell'Italia. La risposta del tesoro a questo avvenimento è stata :

''Cio' che stupisce - prosegue il Tesoro - e' che MF confonda le aste, il cui esito e' quello sopra descritto, con i collocamenti supplementari riservati agli Specialisti in titoli di Stato, ai quali e' data facolta', fino alle ore 15,30 del giorno successivo all'asta, to sign - the hammer price - a percentage of the amount offered in the same (in this case 10%). It is therefore a placing at a fixed rate, which the specialists can use in their sole discretion, and the Treasury, in its programming does not rely on the cover emissions resulting potential (though taking into account what it 'obvious in gauging the amounts of subsequent releases).''The response of the ministry is only partly convincing. Considering the high demand from the private treasury bills, I do not see what bizarre calculus specialists should not make a similar option available to them if not for a lack of implicit trust. Italy is the European country that spends more on interest on its debt (about 5% of GDP) this year and will renew an approximate 20% of it (something like a figure of around 300 billion euro). Although current trends suggesting that will not be a problem for the country if the refinance is to keep your eyes open. Given our exposure would be enough a sharp pull on the international markets to precipitate the situation. Although

''If you do a retrospective of additional placements - concludes the note of the Ministry - the kind of''options''available to professionals is clear, it is not at all uncommon, even in favorable market conditions, that there are no requests at that stage. It is noted that the additional issuance, if legally in tranche 'of the bonds to be issued, there since 1994.''

side of public funding should go all right, the crisis will be felt in all its brutality in other sectors. Our economy depends in large part from extremely sensitive to a global recession, such as tourism, the production of luxury goods or the manufacturing of low-level, from which we can not release when we should have.

Industrial production has fallen by a terrifying 12.3% in November compared with a year earlier. The bank d'Italia prevede che il PIL del paese scenderà di un 2% quest'anno e avverte che "la dinamica del prodotto potrebbe essere ancora più negativa se prendessero corpo i rischi di un ulteriore indebolimento dell'economia mondiale". Considerando che i rischi "prenderanno corpo", ci baceremo i gomiti se raggiungeremo un -2% di PIL.

Se sui "pigs" sta piovendo acido puro, anche la spocchiosa Inghilterra non si può certo dire all'asciutto. Dopo aver tagliato i tassi al minimo storico (ora sono all'1,5%) da quando è stata fondata nel lontano 1694, provocando il tracollo della sterlina, la banca centrale inglese ha deciso fosse il caso di tenere segreti i propri libri contabili . Essa potrà print all the money he wants and no one can know how much it puts into circulation or in the words of condemnation spoken by Lord James of Blackheath to the English Room:

"Remove this check and there is nothing that can stop an unmonitored flooded the money market through the use of unruly press.Once again the attempt to re-inflate the market is rather evident. Why central bankers will always rely on this strategy becomes clear by reading a passage from the famous Bernanke speech that took place in 2002 and which earned him the nickname of "Helicopter Ben"

If you travel along the way by a road from Weimar, through Harare and must not end in Westminster and London. "

Despite widespread "inflationary pessimism" in the 80 and 90, most of the central banks of industrialized countries were in the degree of caging the inflation dragon, if not completely tame. Although a number of converging factors have made this achievement possible, an essential element was the high level of understanding by central banks, politicians and much of the public to the high cost that would allow the economy to move away from stability prices.

Translated: central bankers are convinced that they know how to keep inflation at bay e quindi non se ne preoccupano particolarmente. Questa è una delle ragioni principali (ce ne sono altre) per cui ricorreranno a tutte le forme di quantitative easing che riterranno necessarie. Chi dice che una banca centrale abbia il potere di creare inflazione in quantità illimitata ha ragione. Una banca centrale potrebbe effettivamente creare denaro e distribuirlo lanciandolo dagli elicotteri come ha minacciato di fare Bernanke o appenderlo ai rami degli alberi come suggerisce Pritchard o ancora infilarlo dentro a delle bottiglie, spargerle per la nazione ed indire poi una gigantesca caccia al tesoro come postulò (scherzando) Keynes.

Sarebbe più corretto dire che una banca centrale, non può creare inflazione in maniera illimitata sperando di conservare intatto un qualcosa che possa essere definito "economia", come dimostra la situazione dello Zimbawe che a 3 settimane dall'introduzione della banconata da 500 milioni ha dovuto introdurre quella da 50 miliardi. Adesso nel paese africano usano valuta straniera per vendere ed acquistare merci. In questo senso Bernanke e amici non hanno grosse speranze di rimettere in moto l'inflazione. Se cercassero seriamente di farlo, genererebbero uno shock tale da provocare un arresto cardiaco all'intero sistema.

Penso che in futuro l'Inghilterra, assieme alla Spagna, entrerà nei libri di storia come l'esempio di un paese, in cui l'espansione economica negli anni 2000 è stata quasi esclusivamente basata su bolle speculative. Vi ritroviamo all distortions of the U.S. economy, only on a higher scale. Britain, too, like the United States embarked headlong on speculation and U.S. citizens as the British were indebted to the tip of the hair to consume useless crap - in fact we are indebted to an even more marked from the Americans - while the banking system bundle the package and is also up to their necks in debt to invest in all those areas that the global financial bubble was inflating.

The British banking system has ended up exposing too. When you start to see banks with a leverage (the ratio between the money available and the total exposure) of 1:60, as in the case of Barclays, it should be evident that you have exceeded any reasonable limit. In comparison, U.S. banks have made worse the leverage of about 1:30. As soon as the various bubbles burst began the agony of the British banks. Zeroing in demand for complex financial instruments, the terrible conditions faced by hedge funds and private equity, have vaporized much of that financial market that for years had become the first industry in the country.

A banking system is exposed as the English could not survive independently in an event like that. To save the state has intervened effectively nationalizing many institutions (the Royal Bank of Scotland for example). The population also found itself forced to stop consuming with money that did not possess and increase the savings rate . The result was a contraction of the economy and money in circulation. To remedy this, the government has promised several public interventions in the form of investment and tax cuts, such as a reduction of VAT by two percentage points. The result will be a frightening increase in the deficit in the near future: it is estimated 6% of GDP in 2009, but many fear it could soon reach a level of 10% from Latin America (or Greece). Smagni Bisi Lawrence, head of international affairs at the ECB, says that the UK is not material for the euro because of budget deficit and instability in the exchange rate of sterling, which the recent weakening is considered by many as a form of "beggar thy neighour.

France and Germany still remain the major countries of Europe. Their economies are suffering amid many will be those that resist better at this time of crisis.

Germany from its accounts with respect to order, good facilities and good social safety nets, an industry trade balance and a high-level asset. Other hand, has the enormous exposure of its banking sector and a large dependence on the export sector in a time when global demand is almost zero.

Deutsche Bank, for example, although not reaching absurd levels of Barclays has come to have a leverage of 1:52. As with the British bank, the German government has intervened a couple of days ago, acquiring a majority share of the banking giant, in a complex deal for the sale of Postbank - owned by Deutsche Post - the Deutsche itself. Without government intervention the operation could never be completed.

The total exposure of Deutsche has 80% of German GDP. Nor is his failure to be taken into account. If Germany a few days ago has come to nationalize the Commerzbank acquiring a 25% plus one share and speculation on whether the same can be done against Hypo, the financial giant (comparable in size to the former Lehman) got shit completely in the housing market, it is natural that in case of future problems (and there will be) by the Government of the Deutsche will be obliged to intervene further.

The German industrial production data are from war report. In November, the decline was 7.7% compared to the same month last year. In 2008, the country's GDP grew by 1, 3% half since 2007 and exports increased by 3.9% versus 7.5%, again in 2007. The German statistics office estimated that the decline in GDP last quarter was tra l'1,5 e il 2%. Anche se i dati ufficiali saranno rilasciati solo il 13 Febbraio uno dei responsabili dell'ufficio ha detto: "la crescita economica nel 2008 è stata unicamente basata sulla domanda interna". Probabilmente un po' eccessiva come analisi, ma la dice lunga su quanto in fretta l'economia tedesca si stia raffreddando.

Joerg Kraemer capo economista alla Commerzbank ha affermato commentando le previsioni per l'ultimo quarto: " Questo significa che il punto di partenza per il 2009 è pessimo". "Ci aspettiamo che il PIL si contrarrà di un 2-3 percento nel 2009, il che rappresenterebbe il declino peggiore nella storia della Repubblica Federale". Esportazioni in calo e consumi interni stagnati nonostante un alto (per hour) level of employment, are corroding Germany. To answer the question the German Government has decided to act with a stimulus package of 50 billion euro.

usual stuff: tax cuts, expenditure on infrastructure (schools, roads, etc.), bonus for families. The government expects to save 250,000 jobs this way.

France for its part, has repeatedly called for the cooperation of Germany with a view of an economic stimulus plan coordinated at the European level and always receive a negative response. The Germans do not want to spend their money to keep the "pigs". They fear if they did, to lay the foundations for the future adoption of the common forms of debt, which is not absolutely in their interest.

France also going through a difficult time. The luxury market, one of the highlights of the French economy is in trouble : Channel has fired the 1% of its workforce (slightly, but enough to arouse dismay among commentators French), Louis Vuitton has annulled ' Opening in Tokyo I had to be its largest store ever, and champagne sales were down 16.5% in October. Industrial production in November fell by 2.4 over the previous month compared to an expected decline of 0.8%. The decrease year on year by 6.5%. The largest contribution to the collapse of industrial production has given him the car industry with a monthly drop of 8, 1% in November after having fallen by 22.2% in October. The situation is severe enough to push the President Sarkozy to announce measures of direct financial assistance from the government for the whole sector. In return, the automakers should commit to strengthening the production in France by limiting the practice of outsourcing. It is also rumored to the next state aid to Airbus. The aviation giant has said to expect a halving of orders in 2009 over the previous year.

From this quick overview of the situation of some major European countries should be clear why Many believe that the worst conditions in Europe to the United States.

is an entity without an economic policy or monetary policy. Although most of the countries that compose it (16 now) falls under the protection of the euro 11 others are left out. They are mostly small states in Eastern Europe still retain its own currency and on almost all the bad economic situation in serious condition. In the boom years of the investment are realized attracted by high growth rates that they could boast. When the crisis erupted in the capital have fled their heels leaving behind businesses, and individuals were heavily indebted to international currency: U.S. dollar, euro, Swiss francs Swiss and even yen. The result of this flight was the devaluations of local currencies, which consequently led to an increase in real terms of the stock.

The stability of these countries is important for nations in the euro area since they are among those who have invested the most in the region of Eastern Europe. So for right or wrong we will have to save them if necessary.

Another problem of Europe is not able to issue debt policy. Each state must finance themselves. This means that any difference in the stability of the economies is reflected by the difference in yields that every state has to promise to pay on its debt. In other words è molto più sicuro investire nel debito di in un economia "compatta" (pur con tutte le differenza tra i vari stati) come quella USA che non nella singola Italia o Inghilterra. In un momento a cui il mercato sembra comprensibilmente interessare solo la sicurezza, significa che gli stati visti come più pericolanti (Grecia, Irlanda ecc) potrebbero avere in futuro dei problemi a vendere il proprio debito.

Mentre stavo scrivendo questo post, Willem Buiter ha pubblicato un articolo che riflette bene alcune delle argomentazioni che avanzai in passato. Buiter afferma che sia assurdo, anche solo pensare che qualche paese dell'area euro possa decidere di abbandonare la moneta unica. L'effetto positivo che deriverebbe dalla svalutazione a competitive local currency runs out, leaving the country in question, at the mercy of a market ruled by giants in the economic policy it should adapt. A local currency would quickly be a burden. The example of Iceland stands still in the minds of politicians, as an enduring reminder of the consequences that may result from having a currency is too weak and insignificant at the international level.

No country voluntarily abandon the euro. Whatever you may say political parties such as the alloy. If for some reason Italy was driven by the euro, and Bossi would see the company go to Bruxless crawl and beg other countries to make us fall. They can scream that they want their supporters to Pontida, between sips of water while '(I hope the first depurino) and a slice of polenta, but they are not stupid. They know that abandoning the euro would be a disaster for Italy.

Buiter welcomes any European country having to issue his personal debt, a joy that frankly do not understand. The spread between yields on Treasury bonds of individual European countries is increasing continuously. The good of Greece promise to yield 2.12% more than in Germany, a catkin of 10 times in the last 2 years. John Authers in the Financial Times says that the market is considering the probability that one of the eurozone countries to abandon the single currency until the end of the year to 30%. Buiter does not care about the thing. He says that the increase in spreads on sovereign debt will force countries to adopt a worst form of stricter fiscal discipline and therefore will have a positive effect.

expect that we will, in default of sovereign debt by countries within and outside the euro area, forecast with which I agree, but does not bother to analyze the consequences. What they decide to make the other European countries facing the default of a state within the single currency?

An indication on the road that could take Europe in such a case, comes from the decision by the ECB to loosen the requirements on guarantees accettabili in cambio di prestiti. Il debito sovrano era eleggibile fino ad un rating di A-. Un altro abbassamento di rating avrebbe messo fuori gioco i buoni del tesoro Greci. La BCE ha quindi deciso in via transitoria (di questi tempi il transitorio ha il brutto vizio di diventare permanente) di accettare debito sovrano fino al rating BBB-, cioè fino al limite inferiore di quello che viene definito "investment grade" (livello da investimento).

Con tutta probabilità in caso di default su alcune tranche di debito pubblico, verrebbero semplicemente allentati i vincoli economici imposti dall'Unione e come ritiene Buiter il default verrebbe definito "ristrutturazione." In pratica l'Europa cercherà di nascondere la polvere sotto il tappeto as long as possible. Obviously there is a limit beyond which other countries do not agree to go because the cost of supporting countries to shoulder the failures would become excessive.

This economic crisis will stand the test of 9 for the compactness of the European Union. The year that has just started is the worst it has ever seen in his short life. Industrial production continues to decline. Factories, companies, small and medium-sized enterprises license by increasing the rate of unemployment. In 2008 in Italy was 6.7% for 2009 and economists are predicting that will touch the 8, 4%. In all probability exceed 9% and we get to double figures. Ireland and Spain are already in double figures. Greece is 7.4%, but unemployment among young people aged between 15 and 24 years is 22% (many say the real figure is closer to 30%). Greece has been replicated in the process of impoverishment and insecurity of the young generation that has affected much of the industrialized world and it seems clear that Greece did not know how to respond to the betrayal of that promise by implication, improvement of living conditions that exist between the previous generations and those that follow and the subsequent rebellion of young citizens.

The fuse has been triggered in Greece, but the fire of violent revolt threatens to take root in other countries. At year end, the people of Iceland said the assault , torches in hand, the seat of the second television channel where the prime minister, was discussing the prospects of the country for 2009, including an appetizer and a glass of champagne. The kind of idiotic behavior that I would expect from an Italian politician. Icelanders are generally reserved and a population not prone to violence. E 'to fail because the state saw similar actions. In some European countries, I doubt that you will need to wait that long. The

Eastern Europe is in danger of default again (they never really recovered) and will be re-saved the Union and the IMF, but we can expect very strong social tensions. Greece will not come if to declare default on certain installment of its debt, in danger of going there very close. Pay particular attention to the Mediterranean countries Spain, Portugal, Greece because their future is our future, but their fall will be faster than ours. In the first half of the year probably will not arise on the real problems of financing government bonds, but around September / October I expect a staple of suffering. Europe's response will, as always contradictory and not very timely and is expected to result in substantial suspension (or release if you like) the constraints of stability.

deflationary thrust will continue its course. Consumption will inevitably continue to shrink as the economy will get worse, dragging down the values \u200b\u200bof those assets that past bubbles were inflated. Mainly residential and commercial properties, but also small business or those whose business is based on real easy to cut as clothing or cosmetics will suffer a severe blow. Sales will decline less than discount stores, large supermarkets, large retailers in other words. Will suffer less the impact of the crisis, at least in Italy, electronic objects of desire, such as cell phones or mp3 players (in the first half then he Thin). Also in this area but we will see a heavy compaction. Here is the festival in Bologna the closure of UniEuro (there would actually be a lot to say about their business plans). For the computer will be a bad year and for the automotive market will be even worse.

isolated interventions of the various states will do little to change that.

positive, the Europe than in the U.S. (in most states) a debt the individual child, services that work (public transport to name just one) and a welfare state established, it will not be enough to make a difference. The revenue decline while the states will inevitably increase the deficit. Depending on how this crisis will last for the welfare of devices will be able to provide a cushion or you riveleranno insufficienti. In Italia si sente ripetere un giorno si ed uno no, che i fondi per la cassa integrazione non bastano (e questo senza considerare l'adozione di rigide misure fiscali come suggerisce Buiter).

Per combattere la deflazione la BCE si arrederà e ricorrerà a esplicite misure di quantitative easing, oltre a tagliare ulteriormente il tasso di interesse. Aspettatevi un futuro indebolimento dell'euro, derivante sia dalla politica che adotterà la banca centrale sia dal degradarsi delle economie dei paesi membri. Anche la sterlina continuerà a svalutarsi. La Gran Bretagna sembra non cercare neppure di dissimulare le proprie intenzioni in questo senso.

Le banche del vecchio continente, tranne some cases such as Italian, have higher levels of leverage than their U.S. counterparts. They are therefore highly exposed to the difficulties that the world economy is going through. Some have too much invested in emerging markets, others are unbalancing the first real estate bubble and then in the commodity and others have exposed too much about everything. There is no way that they come out unscathed. Continue to spit blood for all of 2009 and since her failure does not appear to be under discussion, will be saved at taxpayers' expense.

not come from price lists also particularly good news. In exchange, probably will see the replica of what happened this year. If the bag American will fall another 40%, not European ones will fare better, on average, their loss will be higher.

To conclude: if the U.S. did not laugh this year, Europe risks instead of bitter tears. Expect the situation to fester in the fall and keep a close eye on Spain, Greece, Ireland and Eastern Europe. Will be a great barometer to see what awaits us ahead.

0 comments:

Post a Comment